I started using Gomyfinance.com to check my credit score, and it was really easy to understand. The free report gave me a clear view of my score, and I could track any changes in real time. The tips they provided helped me improve my score, and now I feel more confident about my finances.

Gomyfinance.com credit score is a free service that lets you check and track your credit score. It shows your credit report in a simple way and gives updates in real time. The service also provides tips to help improve your score.

Ready to take charge of your credit? Find out how Gomyfinance.com can provide the tools you need to check, track, and improve your score with ease.

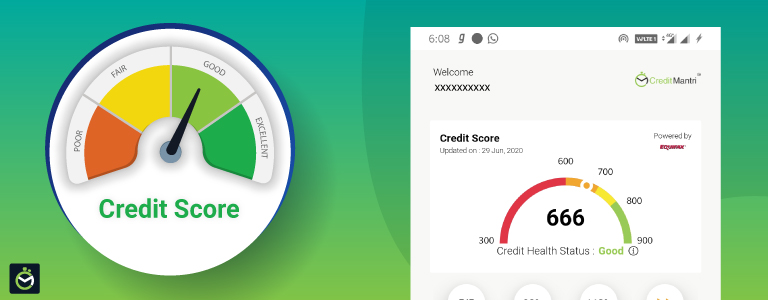

What is a Credit Score and Why Does Your Credit Score Matter? – Take control of your credit!

A credit score is a three-digit number that shows how trustworthy you are when it comes to borrowing money. It’s based on things like whether you pay your bills on time, how much of your credit you use, and how long you’ve had credit.

Your credit score matters because it helps lenders decide if they’ll give you a loan or credit card, and what interest rate you’ll get. A higher score can mean better loan terms, while a lower score might make it harder and more expensive to borrow money.

Read Also: Total Auto Finance Lawsuit – Impact On Consumers!

Which Website is the Best for Checking Your Credit Score? – Choose the best for your credit!

The best website for checking your credit score depends on what you need. Gomyfinance.com is a great choice as it offers free access to your credit score and easy-to-understand reports. It also provides real-time updates and personalized tips to help you improve your score. Other popular websites like Credit Karma and Experian also offer similar services. However, Gomyfinance.com stands out for its user-friendly features and no-cost services.

Step-by-Step Guide to Using Gomyfinance.com Credit Score Services:

Here’s a simple step-by-step guide to using Gomyfinance.com credit score services:

- Sign Up: Visit the Gomyfinance.com website and create an account by entering your basic information, like your name and email address.

- Verify Your Identity: For security reasons, you’ll need to verify your identity. This might involve answering personal questions or uploading documents.

- View Your Credit Score: After signing up, you can immediately access your credit score on your dashboard. It shows your score and factors affecting it.

- Enable Real-Time Alerts: Turn on notifications to get updates about any changes to your credit report, such as new accounts or missed payments.

- Follow Personalized Tips: Gomyfinance.com will give you tips on how to improve your score. Follow these simple actions to boost your financial health.

By following these steps, you can easily monitor and improve your credit score with Gomyfinance.com.

How Can I Sign Up for Gomyfinance.com’s Credit Score Service?

Visit the Website

Go to Gomyfinance.com and find the sign-up page on the homepage. The website is easy to navigate and guides you through the registration. Click the “Sign Up” button to start creating your account. You’ll be directed to a form to enter your details.

Enter Your Details

Fill out the required information, such as your name, email address, and a password. You may also be asked for additional personal details for security. Make sure your information is accurate to ensure your account is set up properly. This information helps Gomyfinance.com protect your account.

Verify Your Identity

For your security, Gomyfinance.com will ask you to verify your identity. You’ll need to answer a few security questions or upload documents like your ID. This helps to keep your data safe and ensures only you can access your account. It’s a quick and easy process.

Access Your Credit Score

Once your account is set up and verified, you can instantly view your credit score on the dashboard. The score is displayed clearly, along with factors that affect it. It helps you understand where you stand financially. This gives you a great starting point for improving your credit.

Set Up Alerts

To stay on top of any changes, enable real-time alerts. You’ll receive notifications if something changes in your credit report, such as a new account or missed payment. These alerts help you catch any issues early and take action to protect your credit score.

Will Checking My Credit Score on Gomyfinance.com Impact My Credit Score? – Check without worries!

Checking your credit score on Gomyfinance.com won’t impact your score. The service uses a soft inquiry, which does not affect your credit rating. This means you can safely check your score without worrying about any negative effects.

You can review your credit score as often as needed without it dropping. A soft inquiry is just a way to view your credit without causing any harm. It’s a risk-free way to stay updated on your financial health.

How Accurate is the Credit Score Provided by Gomyfinance.com?

The credit score provided by Gomyfinance.com is based on data from major credit bureaus, ensuring it is accurate and reliable. However, it’s important to note that the score may vary slightly from the one used by lenders, as different scoring models are sometimes used. Gomyfinance.com uses widely recognized models to give you a solid idea of your credit standing, but the exact score might differ depending on the model a lender uses. Overall, it provides a good representation of your credit health.

Can I Track My Credit Score in Real-Time with Gomyfinance.com?

Yes, you can track your credit score in real-time with Gomyfinance.com. The service sends you real-time alerts whenever there is a change to your credit report. This could include things like a new account being opened or a missed payment. These alerts help you stay on top of your credit status and make it easier to spot any issues. By receiving updates immediately, you can take action quickly if needed. It’s a helpful tool to keep your credit health in check.

Read Also: Carlos Monzon Finance – Mastering Equity & Financial Advisory!

How Can I Improve My Credit Score Using Gomyfinance.com?

Here’s how you can improve your credit score using Gomyfinance.com:

- Follow Personalized Tips: Gomyfinance.com provides specific advice to help improve your credit score. These tips are based on your credit report and history.

- Pay Down Credit Card Balances: Reducing your credit card debt can have a big impact on your score. It shows you’re managing your credit well.

- Set Up Automatic Payments: This ensures you never miss a payment, which helps maintain a good payment history. A strong payment history is key to a better score.

- Reduce Credit Utilization: Keeping your credit usage below 30% of your limit improves your score. High credit utilization can lower your score.

- Track Progress: Gomyfinance.com provides real-time alerts for any changes. This helps you stay updated and make improvements quickly.

What Personalized Tips Does Gomyfinance.com Provide to Improve My Credit Score?

Gomyfinance.com provides several personalized tips to help improve your credit score, including:

- Pay Down Balances: Reducing high credit card balances can significantly improve your score by lowering your credit utilization ratio.

- Make Payments on Time: Setting up automatic payments or reminders can help you avoid missed payments, which can negatively impact your score.

- Diversify Your Credit: Having a mix of credit types, like credit cards and loans, may help improve your score over time.

- Dispute Errors: If there are any mistakes on your credit report, Gomyfinance.com can guide you on how to dispute them to have them corrected.

- Limit Hard Inquiries: Avoid opening too many new accounts in a short period, as this can lower your score due to hard credit checks.

These tips are tailored to your specific credit report and can help you take actionable steps to improve your credit health.

Does Gomyfinance.com Provide a Credit Score for All Three Major Credit Bureaus?

Gomyfinance.com provides a credit score based on data from one major credit bureau, like Equifax, Experian, or TransUnion. It does not provide scores from all three bureaus at the same time. Your score might differ slightly depending on which bureau’s data is used.

Each credit bureau reports slightly different information, so your score could vary between them. However, Gomyfinance.com gives you an easy-to-understand view of your credit. This helps you track your score and make improvements.

How Does Gomyfinance.com Compare to Gomyfinance.org?

Gomyfinance.com and Gomyfinance.org serve different purposes in financial management. Here’s a comparison of the two platforms:

Gomyfinance.com

- Focus: Focuses on helping users manage and improve their credit score. It provides tools for monitoring credit health.

- Key Features: Offers free credit score checks, real-time alerts, and personalized tips. Helps users track and improve credit scores.

- Tools and Resources: Includes credit calculators, educational resources, and progress tracking tools. Helps users understand and improve their credit.

- Accessibility: All services are free and accessible to anyone. No hidden fees or charges for basic features.

- Limitations: Doesn’t offer advanced financial services, like investment advice. Focuses mainly on credit score management.

Gomyfinance.org

- Focus: Likely focuses on promoting financial literacy and providing educational resources. Aims to help users improve their financial knowledge.

- Potential Offerings: Offers free guides and resources on financial education. May include workshops or community programs for better money management.

- Community Impact: As a non-profit, it likely focuses on supporting communities with financial knowledge. Helps users make informed financial choices.

- Limitations: May not have credit score tools or personalized alerts. Focuses more on general financial literacy rather than credit score management.

Overall, Gomyfinance.com specializes in credit score management, while Gomyfinance.org may focus on broader financial education.

Are There Any Hidden Costs Associated with Gomyfinance.com?

There are no hidden costs with Gomyfinance.com. The platform offers free credit score checks, real-time monitoring, and personalized tips at no charge. You can access all these basic services without paying anything. While some advanced features or premium services might have a cost, the core features remain completely free. This makes it easy for anyone to monitor their credit score without any surprise fees.

Frequently Asked Questions:

What is a good FICO credit score?

A good FICO credit score is typically 700 or higher. It indicates strong creditworthiness and makes it easier to get loans with favorable terms.

What is the only free and legitimate way to check your credit score?

The only free and legitimate way to check your credit score is through AnnualCreditReport.com or services like Gomyfinance.com that provide free credit score checks.

Does anyone have a 900 credit score?

A 900 credit score is extremely rare and is considered the highest possible score, but most people fall below this range.

How rare is an 800 credit score?

An 800 credit score is very rare, achieved by only about 20% of people. It represents excellent credit.

What is the highest credit score to buy a house?

The highest credit score to buy a house is generally 850, which can help you secure the best mortgage rates. However, scores in the 700s are also good for qualifying for a home loan.

Conclusion:

Gomyfinance.com credit score services are a great way to manage and improve your credit. It offers free credit score checks, real-time alerts, and personalized tips to help you stay on top of your credit. The platform is easy to use, making it a good choice for anyone, even beginners. While it doesn’t offer premium services, its core features are reliable and effective for improving credit health. Overall, Gomyfinance.com is a helpful and free tool for better credit management.

Read Also:

Leave a Reply