NVIDIA Corporation has in fact been the company I have been following the journey of in the stock market closely. Today, I am eager to give a summary of NVIDIA’s stock sector, as seen on Yahoo Finance. The internet has literally transformed into an essential source for investors who want up-to-date information and complete financial data.

NVDA Yahoo Finance refers to the comprehensive financial data and stock performance of NVIDIA Corporation (NVDA) available on Yahoo Finance. It includes key metrics like stock price, market cap, earnings reports, and growth trends. This platform provides real-time updates and insights for investors tracking NVIDIA’s financial performance.

The Rise Of Nvidia – A Brief Overview!

NVIDIA was founded in 1993 and has since evolved from a graphics card manufacturer to a leader in AI computing. The company’s GPUs (graphics processing units) are integral to gaming, professional visualization, data center operations, and automotive markets. Recently, NVIDIA has gained significant attention for its role in AI, particularly with the advent of generative AI technologies.

Understanding Nvda’s Financial Performance On Yahoo Finance!

Stock Overview

NVIDIA, traded under the ticker symbol NVDA, is a market leader in the semiconductor and GPU industry. As of the latest data, NVDA boasts a market capitalization that places it among the most valuable tech companies globally. On Yahoo Finance, investors can view key data like the stock price, market cap, and 52-week highs and lows. These numbers give investors a snapshot of NVDA’s current standing in the market.

The stock price of NVDA has shown a significant upward trajectory in recent years, fueled by the booming demand for GPUs in gaming, AI, and data centers. Market cap is a critical indicator of the company’s size and its value in comparison to competitors, which investors can track over time through Yahoo Finance charts.

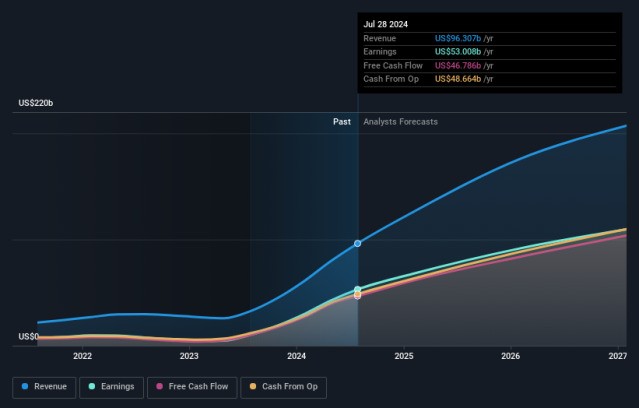

Revenue and Profit Growth

One of the main factors investors look at when assessing the potential of a stock like NVDA is its revenue and profit growth. Yahoo Finance offers a breakdown of quarterly and annual reports, showing how much revenue NVDA generates and its net income. The company’s revenue has been growing steadily, driven by its dominance in the gaming industry, along with emerging opportunities in AI, autonomous vehicles, and data centers.

Recent earnings reports on Yahoo Finance indicate that NVDA has been able to deliver strong earnings, which is a key metric for any investor. Moreover, it’s important to look at NVDA’s gross profit margin to gauge the efficiency of its operations and the profitability of its products.

Key Financial Ratios:

For a deeper understanding of NVDA’s financial health, investors can analyze various financial ratios, such as the Price-to-Earnings (P/E) ratio, the Price-to-Sales (P/S) ratio, and the Return on Equity (ROE). These ratios help investors understand how NVDA compares to other companies in the semiconductor and technology sectors.

- P/E Ratio: A high P/E ratio suggests that investors are willing to pay a premium for NVDA’s stock based on future growth expectations.

- P/S Ratio: The P/S ratio indicates how much investors are willing to pay for each dollar of NVDA’s sales. A lower P/S ratio may suggest that the stock is undervalued compared to its revenue potential.

- ROE: NVDA’s return on equity is an important metric for assessing how effectively the company is utilizing shareholders’ equity to generate profits.

By using these ratios, investors can benchmark NVDA’s performance against other key players in the semiconductor industry.

Nvda On Yahoo Finance – Analyzing Stock Movement And Trends

Historical Performance:

Looking at the historical performance of NVDA is crucial to understanding its growth trajectory. Over the last five years, NVDA’s stock has seen significant growth, driven by both organic revenue growth and market optimism around the potential of AI, gaming, and data centers.

Yahoo Finance offers interactive charts where investors can analyze the stock’s price movement over various time periods. By reviewing this data, investors can identify key moments when the stock experienced growth or decline, often tied to product launches, earnings announcements, or shifts in market sentiment.

For example, NVDA’s surge in 2020 and 2021 was attributed to the increasing demand for GPUs during the pandemic, as more people turned to gaming and remote work solutions. The historical data helps investors recognize these trends and make educated predictions about future performance.

Recent Stock Performance:

In addition to long-term trends, it’s important to examine NVDA’s short-term stock movements. Yahoo Finance provides detailed daily and weekly charts that display price fluctuations and trading volume. These short-term price changes can offer valuable insights into market sentiment and investor behavior.

Recent movements in NVDA’s stock have been influenced by quarterly earnings reports, announcements about new product launches (such as updates to their graphics cards), and broader market conditions. For instance, a strong earnings report or a strategic partnership can lead to a significant uptick in the stock price.

Volatility and Risk:

Volatility is an essential factor to consider for investors. Yahoo Finance provides a “beta” value for NVDA, which measures its stock’s volatility compared to the overall market. A beta greater than 1 indicates higher volatility, while a beta lower than 1 suggests lower risk.

NVDA’s beta has historically been higher than 1, suggesting that the stock can be more volatile than the broader market. While this may present opportunities for growth, it also means there could be larger price swings, which some investors may view as a risk.

Read: Carmax Auto Finance –Flexible Loan Options For Every Budget!

Recent Market Performance – Breaking Down 0f Recent Market!

Stock Surge Amid AI Boom

| Metric | Value |

| Stock Growth (Past 5 Years) | Over 2,600% |

| October 2024 Stock Surge | Approximately 13% |

| Year-to-Date Growth (2024) | 180% |

| Current Market Position | Most valuable company globally |

| Competitors Surpassed | Apple and other tech giants |

| Primary Drivers of Growth | Dominance in AI chip manufacturing and robust quarterly performances |

Upcoming Earnings Report

| Metric | Value |

| Earnings Report Date | November 20, 2024 |

| Predicted Sales Growth | +83% year-over-year |

| Predicted Profit Growth | +83% year-over-year |

| Growth Driver | Demand for Blackwell AI chips |

| Short-Term Concerns | Overheating issues with new chips |

Analyst Opinions And Price Targets – Price Insights!

Compiled by Yahoo Finance, there are analyst opinions and price targets for NVIDIA stock. These pieces of information can be very useful to the investors who are intending to measure the market sentiment and the future performance.

Understanding Analyst Ratings

Analyst ratings are commonly classified as follows:

- Strong Buy

- Buy

- Hold

- Underperform

- Sell

These ratings are predicated on intense scrutiny of the company’s performance, market position, and growth potential.

Price Targets

Although the analysts give the prices that they believe the stock will get to in the future, the prediction of the stock’s price is still a matter of debate. Vale the fact that these are mere estimations and they may possess both positive and negative aspects.

Read: Subaru Motors Finance – Affordable Loans & Lease Options!

News And Press Releases – Key Announcements And Insights!

Mirrored to this, the NVDA Yahoo Finance page features a self-contained news line particularly associated with NVIDIA. The section opens up the reader’s mind and readiness to take from the articles. e.g.;

- Quarterly earnings reports

- New product announcements

- Partnerships and acquisitions related to the company

- Changes in the market which can really positively or negatively influence the share price of NVIDIA

Options And Derivatives – Tips For Smart Trading!

For the more advanced investors, Yahoo Finance gives info on NVIDIA options. This may cover:

- Call and Put options

- Strike prices

- Expiration dates

- Volume and open interest

To trade the options you have to know what the term call option means and understand how it is different from the put side. Further, the strike price is the price at which you can exercise the options defined. Speaking of the expiration date, it is the last day when the buyer has the exclusive right to buy the options contract.

Market Position And Competitive Landscape – What You Need To Know!

Comparison with Competitors:

NVIDIA’s position in the market is bolstered by its innovative products and strategic partnerships. While companies like AMD and Intel also compete in the semiconductor space, NVIDIA’s focus on AI applications gives it a unique advantage. The company’s GPUs are not only used for gaming but are also critical for machine learning tasks and data analysis.

| Company | Market Focus | Key Product | Recent Performance |

| NVIDIA (NVDA) | AI & Graphics | Blackwell Chip | +180% YTD Growth |

| AMD | Gaming & Computing | Radeon GPUs | Steady growth but less focus on AI |

| Intel | General Computing | Xe Graphics | Struggling with market share |

Nvda Vs. Other Semiconductor Stocks – A Comparative Analysis!

Comparing Performance with Peers

It’s important to understand how NVDA stacks up against its competitors in the semiconductor sector, such as AMD, Intel, and Qualcomm. By comparing key financial metrics, such as revenue, profit margins, and stock performance, investors can better assess whether NVDA is outperforming its peers.

Growth Prospects

NVDA’s growth prospects are strong, especially given its position in AI and data centers. However, competitors like AND are also making significant strides in similar markets, which could impact NVDA’s market share and future growth.

Investor Sentiment And Future Outlook – Is Nvidia A Buy?

Analyst Ratings

The sentiment around NVDA remains overwhelmingly positive, with 59 out of 63 analysts rating it as a buy or strong buy. The average target price is set at approximately $160, indicating further upside potential from current levels. Analysts attribute this optimism to NVIDIA’s significant lead in AI technology and anticipated growth in demand.

Risks and Challenges

Despite its successes, NVIDIA faces challenges that could affect its stock performance. Regulatory pressures related to sales restrictions to China have already impacted earnings forecasts. Additionally, any technical issues with new product lines could lead to volatility in stock prices post-earnings announcement.

Read: In House Financing Car Lots Near Me – Drive Off Today With No Hassle!

FAQ’s:

1. What Factors Influence Nvidia’s Stock Price On Yahoo Finance?

Earnings reports, market trends, product innovations, and broader economic factors such as inflation or supply chain issues can affect NVDA’s stock price.

2. How Do I Analyze Nvda’s Earnings Reports On Yahoo Finance?

Earnings reports can be found under the “Financials” section on Yahoo Finance. Look at revenue, earnings per share (EPS), and net income to evaluate the company’s performance.

3. What Is Nvidia’s P/E Ratio, And How Does It Compare To Competitors?

The P/E ratio helps measure stock price relative to earnings. A high P/E ratio may indicate investor optimism. Compare NVDA’s ratio to competitors like AND for context.

4. What Is Nvda’s Market Capitalization?

NVDA’s market cap represents the company’s total market value and is listed prominently on Yahoo Finance.

5. Is Nvidia A Good Investment For Long-Term Growth?

With its leadership in gaming, AI, and data centers, NVDA offers strong long-term growth potential, though market conditions can impact short-term performance.

6. What Are The Risks Associated With Investing In Nvda?

NVDA faces competition, market volatility, and the potential impact of global supply chain issues, which can affect its stock price.

7. How Can I Use Yahoo Finance To Track Nvda’s Performance?

Yahoo Finance offers interactive charts, financial statements, and analyst reports to help track NVDA’s stock and financial health.

8. What Are Nvda’s Growth Prospects In Ai And Gaming?

NVDA is poised to benefit from the growing AI market and gaming industry, as its GPUs are central to both sectors.

Conclusion:

In our analysis of the NVDA Yahoo Finance webpage, we could see that this web facility is the source of the owners of NVIDIA stock who need to get a complete understanding of the company, its financial performance, as well as the competitive landscape it operates in.

It has everything from the continuous current price on the stock market to a complete financial statement, including the analyst’s opinion on the one hand and the up to date news on the other hand. In particular, it offers a lot of substances for either your mild investigation or making the big decisions that you have to make.

Leave a Reply