Finding the perfect car can be a daunting task, especially when dealing with financing options. If you’re searching for in house finance car lots near me, you’re likely looking for a seamless purchasing experience without the hassle of traditional bank loans.

Race Auto Sales in San Antonio provides flexible in-house financing, allowing customers with bad or no credit to get approved. You can buy a used car directly from the dealership, paying CarHop instead of a bank or third-party lender.

In this article, I reveal the best places that offer in-house financing, making it possible at a time to locate the most suitable car which suits your budget as well as meets your needs.

Understanding In-House Financing Car Lots

Before we talk about the various car retailers, it is important to have a brief description of what in-house financing means and how it can be a plus for a lot of people. In-house financing is the act of dealers selling cars and usually giving loans borrower-to-lender, not the other way round where third party financial services are normally involved.

This scheme will especially be beneficial to those with subprime credit or individuals who have had previous misadventures in obtaining traditional car loans. The agility of in-house financing car lots is that they often can work with a wider range of a family’s financial situation and are more eager to through the approval process.

What Are The Benefits Of Choosing In-House Financing Car Lots?

Through these in-house financed dealerships and through conversations with car buyers, I realized many benefits for in-house financing. Specifically, I determined that the in-house financing option may best serve these purposes:

- Flexibility: These in-house financing car lots such as the one in question here are seen as facilities that tend to give more slack to the requirements for the loans thus successively targeting the people with less-than-perfect credit.

- Convenience: The benefit of being able to address both the vehicle purchase and financing issues at one place can drastically reduce the time you would spend at the car dealership.

- Personalized Service: A lot of such dealers describe their goal as being to treat each customer in a unique and special way, thus finding a personalized path to help them with their vehicle and financing problems.

- Quick Approvals: In house financing often allows for faster loan approvals compared to traditional bank loans, which is significant for emergency vehicle needs.

- Potential for Better Rates: Customers who are refused to be financed by banks can get more affordable deals through these dealers that are usually more flexible with credit conditions. In some cases, these banks are the best option for these customers.

Top In-House Financing Car Lots In Anchorage

With research and visits, I identified the following car lots in house financing near me options in Anchorage:

Good Guys Auto Sales LLC – Quick Weekend Financing:

Good Guys Auto Sales LLC is a standing ovation dealer at 640 Gambell St and is the most trusted company for their fast help in the finance matter. With a 4.5-star rating out of 225 reviews, it stands out because of its extraordinary customer service.

- Monday–Friday: 10 AM–6 PM

- Saturday: 11 AM–6 PM

- Sunday: Appointment Only

Contact Information:

| Category | Details |

| Address | 640 Gambell St, Anchorage, AK 99501 |

| Phone | (907) 644-0604 |

AUTOHOUSE: Great Deals and Flexible Financing

AUTOHOUSE is located at 418 Unga St and has won me over because of the combination of smart pricing and the ability to pay for the car in a way that suits you best. Even though they only have a total of 28 reviews, they maintain an impressive 4.9-star rating, indicating excellent customer service.

- Monday–Friday: 9:00 AM–6:00 PM

- Saturday: 9:00 AM–3:30 PM

- Sunday: Closed

Contact Information:

| Category | Details |

| Sales Phone | 877-773-6525 |

| Address | 1280 Velp Ave, Green Bay, WI 54303 |

Red White & Blue Auto Sales | Patriot Auto: Budget-Friendly Financing

Red White & Blue Auto Sales (Patriot Auto) is a local business located at 5740 Old Seward Hwy, offering various loans that correspond to any budget. With a 4.4-star rating out of 337 reviews, this dealership is a leader in its domain, capable of serving a wide range of customer segments.

- Red White & Blue Auto Sales: Open Wednesday–Saturday, 10 AM–7 PM.

- Patriot Auto Sales: Open every day, 10 AM–8 PM.

Contact Information:

| Category | Details |

| Address | 5740 Old Seward Highway, Anchorage, AK 99518 |

| Phone | (907) 561-5941 |

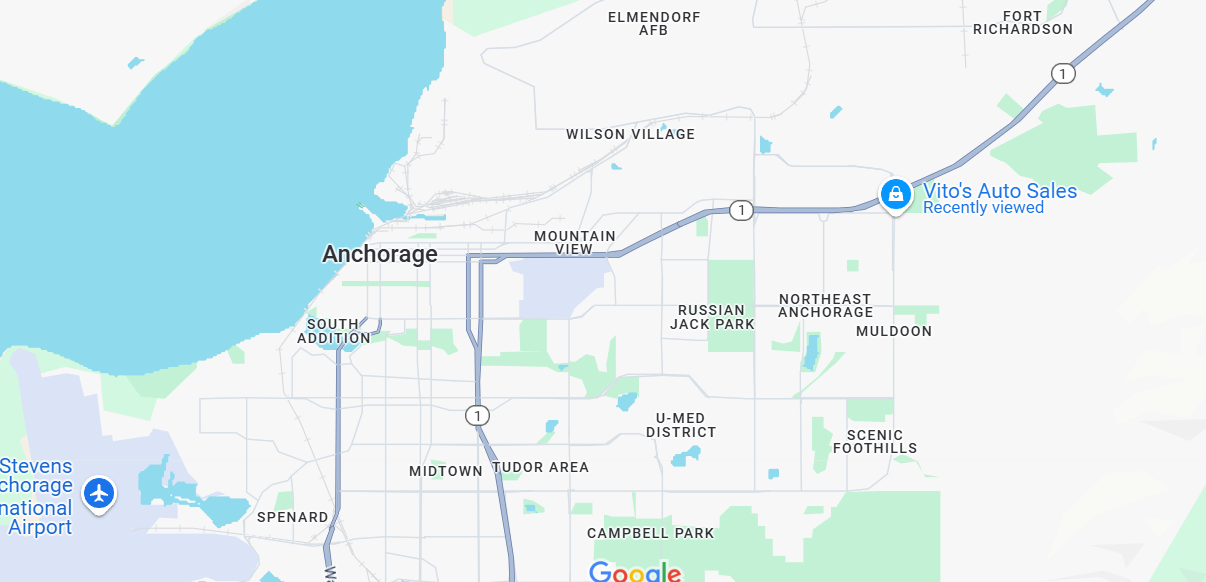

Vito’s Auto Sales: Fair Loans and Vehicle Assistance

Vito’s Auto Sales is located at 149 Muldoon Rd and holds a 4.6-star rating out of 410 reviews. What makes them stand out is their focus on both assisting customers in selecting the right vehicle and forming suitable loan deals.

- Monday: Closed

- Tuesday–Sunday: Opens at 10 AM

Contact Information:

| Category | Details |

| Address | 149 Muldoon Rd, Anchorage, AK 99504 |

| Phone | (907) 277-3336 |

How To Choose The Right In House Financing Car Lot Near Me?

Evaluate Reputation and Trustworthiness

Choose dealerships with a strong reputation for honesty and customer satisfaction. Look for those accredited by organizations like the Better Business Bureau (BBB) and check for any past complaints or legal issues.

Assess Customer Service

Excellent customer service can significantly enhance your car buying experience. Friendly, knowledgeable staff who are willing to answer your questions and guide you through the financing process are invaluable.

Look for Transparent Practices

Dealerships that are upfront about their pricing, financing terms, and policies are more likely to provide a trustworthy experience. Avoid dealerships that pressure you into quick decisions or hide important information.

Location:

Search for car lots near me in house financing to find options within your vicinity.

7 Proven Strategies To Find The Best In House Financing Car Lots Near Me:

Research Local Dealerships Offering In House Financing

Start by identifying dealerships in your area that provide in-house financing. Use search engines with the focus keyword “in house financing car lots near me” to find relevant listings. Additionally, visit dealership websites to confirm their financing options and read customer reviews to gauge their reputation.

Pro Tip: Utilize online directories and platforms like Google My Business to find highly-rated dealerships offering in-house financing.

Check Dealership Ratings and Reviews

Before committing to a dealership, examine their ratings and customer feedback. High ratings and positive reviews indicate reliable service and trustworthy financing options. Pay attention to comments about the financing process, customer service, and overall satisfaction.

Example: A dealership with a 4.8-star rating and numerous positive reviews is likely to provide a better financing experience.

Compare Financing Terms and Interest Rates

Different dealerships offer varying financing terms and interest rates. It’s essential to compare these aspects to ensure you’re getting the best deal. Look for transparent terms with no hidden fees and competitive interest rates that fit your budget.

Key Factors to Compare:

- Interest Rates: Lower rates save you money over the life of the loan.

- Loan Terms: Shorter terms can reduce the total interest paid.

- Down Payments: Determine how much you need to pay upfront.

Assess the Vehicle Selection and Pricing

A dealership with a wide selection of vehicles allows you to choose the best option that fits your needs and budget. Compare prices across different dealerships to ensure you’re getting a fair deal. Remember to consider factors like mileage, condition, and warranty when evaluating used cars.

Tip: Look for dealerships that regularly update their inventory and offer certified pre-owned vehicles for added peace of mind.

Understand the Application Process

Each dealership may have a different application process for in-house financing. Familiarize yourself with their requirements, such as necessary documentation and eligibility criteria. Preparing these in advance can expedite the approval process and improve your chances of securing favorable terms.

Common Requirements:

- Proof of Income: Pay stubs or tax returns.

- Credit History: Some dealerships may require a credit check.

- Identification: Valid driver’s license or ID card.

- Proof of Residency: Utility bills or lease agreements.

Negotiate the Terms

Don’t hesitate to negotiate the terms of your financing agreement. Dealerships may be willing to adjust interest rates, loan terms, or down payment requirements to secure your business. Effective negotiation can lead to better financial terms and a more affordable monthly payment.

Negotiation Tips:

- Know Your Credit Score: Understanding your credit can help you negotiate better terms.

- Be Prepared to Walk Away: Showing that you’re willing to leave can give you leverage.

- Ask for Incentives: Inquire about promotions or discounts that can reduce the overall cost.

Review the Contract Carefully

Before signing any financing agreement, thoroughly review the contract to ensure all terms are clear and agreeable. Pay attention to interest rates, loan duration, monthly payments, and any additional fees. Don’t hesitate to ask questions or seek clarification on any aspect of the contract.

Important Clauses to Check:

- Prepayment Penalties: Fees for paying off the loan early.

- Late Payment Fees: Charges for missed or delayed payments.

- Total Loan Cost: The total amount you’ll pay over the life of the loan.

Considerations When Choosing An In-House Financing Car Lot

While buying a car from dealerships who offer in-house financing has obvious merits, the approach, however, has to be very considerate and careful. Here are some of the things on which one should be unyieldingly resolute:

- Interest Rates: Being smart about the comparison of interest rates from different selling points and perhaps an eventual bank is the best financial control resource.

- Loan Terms: Be careful with the duration of the loan and mind that any fine due to early repayment must also be in your head.

- Vehicle Quality: Making sure a new Certified Pre-Owned Warranty system is in place alongside the dealer’s dedication to the highest level of vehicle service is your top responsibility.

- Customer Reviews: Grab the first morsel from the site and then delve into the comment sections to find out first-handedly how the customer is treated and how well it gets satisfied.

- Transparency: Be clear in your decision for a dealership that explains all payments and cost items and factors accordingly with the purchase and finance part of the payment.

FAQs:

What Is In-House Financing At A Car Dealership?

What is in-house financing, at a car dealership in particular, refers to the fact that the car dealer will loan directly to the customer funds to buy a vehicle, instead of having to find a third-party bank or credit union to connect them to the money necessary.

Can I Get In-House Financing With Bad Credit?

Yes, in-house financing car lots near me are more flexible with credit requirements, making them ideal for bad credit buyers. The bad credit car buyers have nothing to lose but all to win if they choose in-house financing car lots. While the approval is not 100% given, it is known that such lenders are more flexible with their credit requirements than traditional banks so most customers actually get approved.

Where can I find the best in house financing car lots near me?

You can find the best in house financing car lots near me by checking online reviews, comparing financing terms, and visiting local dealerships that offer flexible payment options.

Are Interest Rates Higher With In-House Financing?

In-house financing makes the interests wider than the banks system. Even so, if you are on a low credit basis, the dealers that are more accommodating can get better deals through this system that can be lower than the rates of regular banks.

What Documents Do I Need For In-House Financing?

Typically, you will need to have payslips, which are effectively several pay periods of consistent paycheck withholding. Besides the aforementioned documents including a state-issued driver’s license, some dealers may need you to provide some additional documents to make their decision.

Can I Refinance An In-House Auto Loan?

Yes, you can re-finance a quick loan especially if you have a better credit score than previously or have stable employment and regular payment of bills. Nevertheless, in the document with all the terms and conditions, check for the early payoff penalties.

How can I find the used in house financing car lots near me?

To find used in-house financing car lots near me, you can search online using keywords like “used in-house financing near me.” You can also visit local dealerships that offer financing for used cars and check their reviews.

How Long Does The In-House Financing Approval Process Take?

The time for in-house financing to be approved is generally much shorter than for loans from a bank. The same day the application can be done and approved if this is the approach used by the dealer you chose or you and your credit are supportive enough. Even so, the exact time frames will depend on the dealer and other circumstances in your individual case.

How can I find dealerships with no credit check and low down payments near me?

You can search for “Buy here pay here $500 down no credit check near me” to find local dealerships that offer financing with a low down payment and no credit check.

Conclusion

Finding the right in-house financing car lot near me can significantly ease the car-buying process. From Good Guys Auto Sales LLC’s fast approvals to AUTOHOUSE’s flexible payment options, Anchorage offers a variety of choices. Whether you’re looking for car lots in house financing near me or options with no credit checks, these dealerships provide tailored solutions to meet diverse financial needs.

Whether you prioritize a quick approval process, flexible payment terms, or a tailored financing experience, these dealerships cater to diverse financial needs, making car ownership more accessible for individuals with various credit backgrounds.

Leave a Reply