When I needed fast cash for my freelance work, Giggle Finance made the process simple and stress-free. No credit check, just quick approval and funds to help me grow my business.

Giggle Finance is a financial service platform that provides quick funding to gig workers, freelancers, and small business owners. It offers fast, flexible loans or cash advances without requiring a credit check.

Are you a gig worker or small business owner? Giggle Finance could be your solution for quick, no-credit-check funding!

What is Giggle Finance – Get the Funds You Need Quickly!

Giggle Finance is a service that helps gig workers, freelancers, and small business owners get quick funding. It offers loans or cash advances without checking your credit, making it easy for people with less-than-perfect credit to access funds.

With Giggle Finance, the application process is simple and fast. You can get approved quickly and receive funds to help with your business or personal needs. It’s designed to be an easy solution for self-employed individuals who need quick cash.

Who Owns Giggle Finance – Learn More About the Founders!

Giggle Finance was founded by Jared Kogan and Mike Zevallos, two experts with experience in the fintech industry. They created the platform to help gig workers, freelancers, and small business owners access the funding they need.

The founders’ goal is to offer an easy and flexible financial solution for people who often struggle to secure traditional loans due to limited credit history or other barriers.

Giggle Finance Features – Explore the Features!

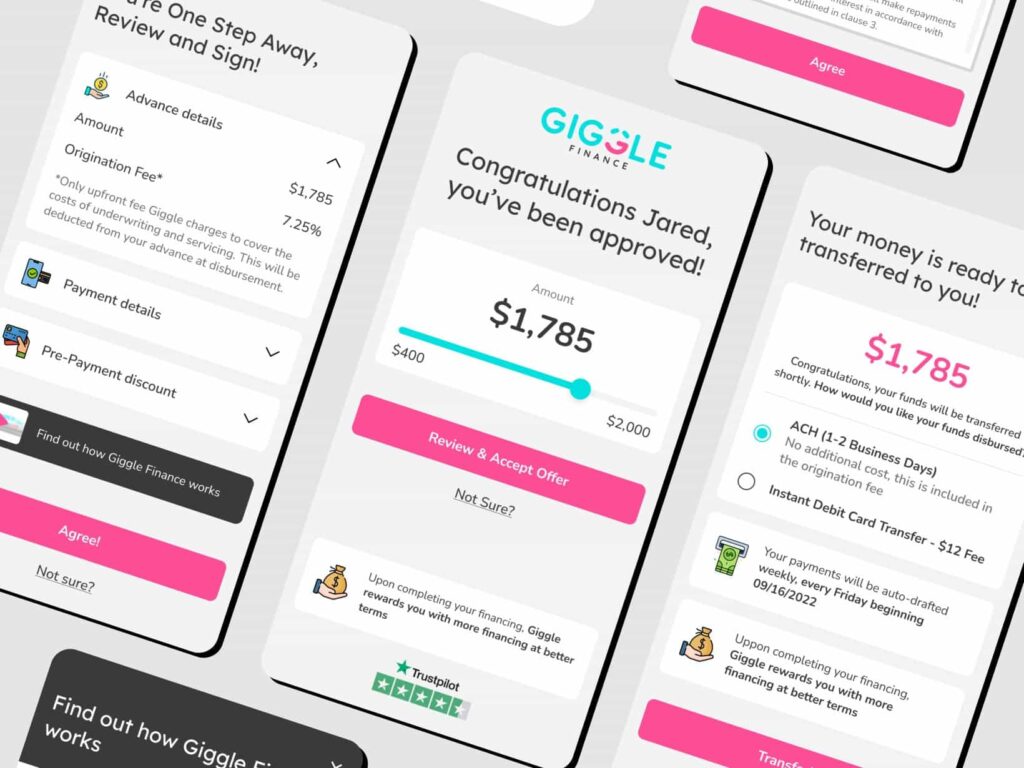

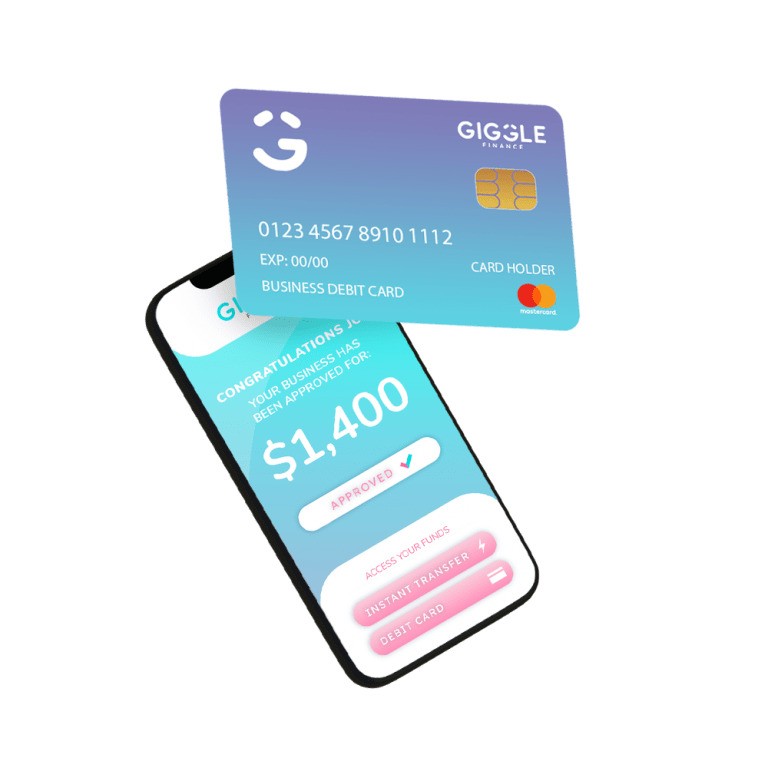

Giggle Finance offers a quick and easy application process, allowing you to apply online and get approved in minutes. There’s no credit check, making it accessible for those with poor or no credit. Once approved, you can get instant funding through a bank transfer or debit card.

Payments are automatically deducted from your bank account based on your future sales, making it easier to manage. Giggle Finance also caters to gig workers, freelancers, and small business owners, offering flexible and secure funding options with the ability to renew for more funds when needed.

Read: Kia Finance – Best Rates And Deals!

How Does Giggle Finance Work – See How Giggle Finance Can Work for You!

- Application: To apply for funding through Giggle Finance, you need to fill out an online application. The process is quick and easy. You’ll connect your bank account securely using Plaid, a tool that helps verify your financial data. You won’t need to provide a lot of documents—just your bank account information.

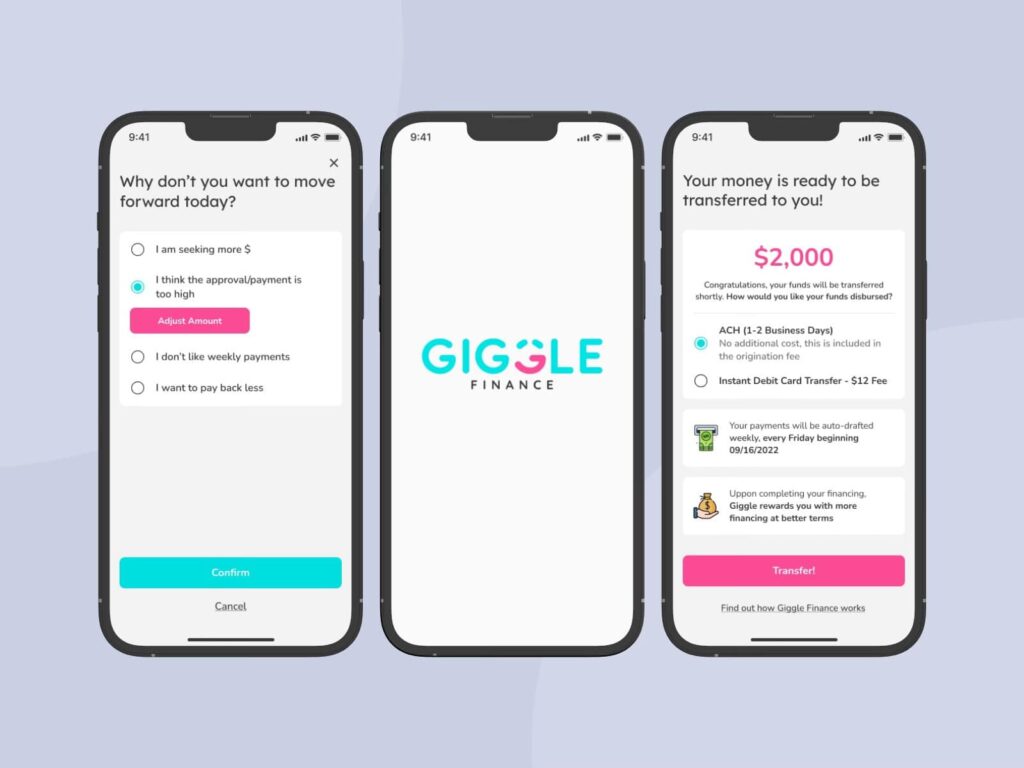

- Approval: Once you’ve submitted your application, Giggle Finance will review your details. They don’t check your credit score, but they do look at your monthly income and other eligibility criteria. Approval can happen in minutes, and if you qualify, you’ll get an offer based on your income and business activity.

- Funding: After approval, you can receive your funds quickly—either through a direct bank transfer or a debit card, depending on your preference. The money is sent directly to you, allowing you to use it right away.

How to Apply for Giggle Finance – Start Your Application Now!

Start the Application:

Begin by visiting the Giggle Finance website and filling out the online application form. It’s a simple process that doesn’t take long. You’ll need to provide some basic information about your business or gig work.

Connect Your Bank Account Securely:

You’ll be asked to securely connect your bank account using Plaid, which helps verify your income and financial activity. This step is essential for Giggle Finance to assess your eligibility for funding.

| Dos | Don’ts |

| Ensure your bank account information is accurate and up-to-date. | Don’t submit incomplete or incorrect details. |

| Review the application form carefully before submitting. | Don’t apply with unrealistic income expectations. |

What Credit Score Do You Need for Giggle Finance?

Giggle Finance doesn’t require a specific credit score to apply. Instead of focusing on your credit history, it looks at your monthly income and business activity. This makes it easier for gig workers and small business owners with lower credit scores to get funding.

As long as you have a steady income and a reliable business, you’re more likely to be approved. Giggle Finance is designed to help people who might struggle to get loans through traditional methods.

Read: In-House Financing Near Me – Top Deals and Tips for Easy Approval!

How Do You Get Approved for Giggle Finance – Get Approved in Minutes!

To get approved for Giggle Finance, you need to have a steady income and be self-employed or run a small business. The platform focuses on your monthly earnings rather than your credit score, making it easier for people with low credit to qualify.

You’ll also need to securely connect your bank account using Plaid for verification. As long as your income is consistent and your information is correct, approval can happen quickly, sometimes within minutes.

Giggle Finance – Advantages and Limitations!

Pros

- Ease of Use: The application process is simple and can be completed online in just a few minutes.

- Fast Funding: Once approved, you can receive your funds almost instantly through a bank transfer or debit card.

- No Credit Score Dependency: Giggle Finance doesn’t check your credit score, making it accessible for individuals with low or no credit history.

Cons

- High Factor Rates: The cost of the loan can be higher due to the factor rate, which is a multiplier of the amount you borrow.

- Limited Loan Amounts: Giggle Finance offers relatively small loans, usually up to $10,000, with new businesses typically getting around $5,000.

Best Giggle Finance Alternatives for Quick and Flexible Funding

If you’re looking for loans like Giggle Finance, there are several options available to help you secure quick and flexible funding without relying on traditional credit scores. These alternatives offer fast approvals and are designed for freelancers, gig workers, and small business owners who need quick access to cash. Below are some of the best alternatives to Giggle Finance:

- Fundbox – Offers fast business lines of credit for freelancers and small businesses with flexible repayment terms.

- Kabbage – A popular option for small business owners offering quick access to working capital based on your business performance.

- LendUp – Provides short-term loans with no credit score requirement, similar to Giggle Finance’s approach.

- Payoneer – Offers cash advances based on future earnings for freelancers and gig workers.

- BlueVine – Provides invoice factoring and lines of credit, offering a great alternative for business owners needing quick funding.

Read: Seal Of Personal Finance – Your Path To Financial Success!

Giggle Finance Costs and Payments – Check Out the Payment Details!

Understanding the Costs

Giggle Finance uses a factor rate to determine how much you’ll repay. This rate is a multiplier of the amount you borrow. For example, if you borrow $5,000 and the factor rate is 1.5, you’ll need to repay $7,500. The exact rate can vary based on your income and business details.

Example Repayment Scenarios

- If you borrow $3,000 with a factor rate of 1.4, your total repayment will be $4,200.

- If you borrow $10,000 with a factor rate of 1.6, your repayment will be $16,000.

Giggle Finance Make a Payment

Making payments on your Giggle Finance loan is easy. Payments are automatically deducted from your bank account based on your future sales. You don’t need to worry about manually making payments, as they’re scheduled according to your sales.

Payment Methods Supported

You can pay using automatic bank withdrawals, which are the main method. Ensure your bank account is connected and active to avoid any missed payments.

Read: Viva Finance – Affordable Personal Loans!

Giggle Finance Login and Account Management – Login securely!

Giggle Finance Login

To log in securely to your Giggle Finance account, open the giggle finance login app or visit their official login page. Enter your registered email and password. For added security, avoid using public Wi-Fi and ensure your internet connection is secure.

Giggle Finance Get Back In

If you’ve forgotten your credentials or been locked out, click on the “Forgot Password” option. Follow the steps sent to your email to reset your password and regain access to your account quickly.

How Long Does Giggle Finance Take – Get Your Funds Fast!

Giggle Finance typically takes only a few minutes to apply and get near-instant approval. Once approved, you can receive your funds almost immediately via a bank transfer or debit card.

However, the process might take a little longer if you’re using a debit card to receive your funds. In general, the entire process from application to receiving funds can take as little as 24 hours.

Read: Top Free Personal Finance Software Unlock Your Financial Potential – Maximize Your Money!

Giggle Finance Contact Information – Contact Us Today for Help!

Giggle Finance Phone Number

To reach Giggle Finance’s customer support, you can call their dedicated helpline at 888-820-7580. Their team is available to assist with any questions or concerns regarding your account or funding.

Email and Other Contact Options

For email inquiries, you can reach Giggle Finance at [email protected]. Additionally, you can visit their website for more contact options and support through their help center.

Giggle Finance Reviews – What Users Are Saying!

| User Type | Review Summary | Rating |

| Freelancers | Quick and simple application process. Funds are received within 24 hours, ideal for urgent needs. | ⭐⭐⭐⭐⭐ |

| Small Business Owners | Fast approval and easy access to funds, but factor rates are high. Some found automatic repayment challenging. | ⭐⭐⭐⭐ |

| Gig Workers | Helpful for short-term cash flow needs. The process is automated, making it fast, but rates are a concern. | ⭐⭐⭐⭐ |

| Startup Owners | Easy to apply with no credit check, but repayment terms could be better. High factor rates may add up quickly. | ⭐⭐⭐ |

| E-commerce Sellers | Excellent for fast funding but need to be cautious about the repayment structure and costs over time. | ⭐⭐⭐⭐ |

Read: Ebay Summer 2024 Finance Internship – Apply Now!

Frequently Asked Questions:

1. What types of businesses can benefit from Giggle Finance?

Giggle Finance is ideal for gig workers, freelancers, and small business owners, including Uber drivers, Fiverr freelancers, Airbnb hosts, TaskRabbit workers, and more.

2. Is there a fee to apply for Giggle Finance?

There is no application fee for Giggle Finance. The only cost you’ll incur is the factor rate, which is applied to the total loan repayment.

3. Can I renew my loan with Giggle Finance?

Yes, you can renew your loan after paying it off, provided you meet the qualifications and continue generating sufficient income to support repayment.

4. What happens if I miss a payment?

Missing a payment could result in additional fees or delayed repayment. It’s essential to stay in touch with Giggle Finance customer support if you face financial difficulties to discuss options.

5. Is Giggle Finance Legit?

Yes, Giggle Finance is a trusted platform that offers quick funding for gig workers, freelancers, and small business owners. It’s known for its easy application process and fast approval.

6. Do I need to have an established business credit score?

No, Giggle Finance does not require a business credit score. Instead, your eligibility is based on your sales and income performance. However, having good financial records can help improve your loan terms.

Conclusion:

Giggle Finance is a fast and easy way for freelancers, gig workers, and small business owners to get quick funding. The application is simple, and funds are often available within 24 hours. However, the high repayment rates and automatic deductions can be challenging, especially if your sales vary.

Leave a Reply